Financial Advisor License Australia . This is a register of people who provide personal advice on investments, superannuation and life insurance. To conduct a financial services business in australia, you must have an australian financial services (afs) licence. Completing a supervised professional year (at least 1600 hours) passing the financial adviser exam. Studying an approved course at a bachelor level or above. Getting optional certification to be a certified financial planner (cfp) Make sure your financial adviser has an australian financial services (afs) licence or is an authorised representative. To become a financial adviser, you must complete: A professional year of supervised experience. You can become a financial adviser or planner in australia by: Afs licensees should ensure that a person they intend to authorise as a financial adviser has. An approved bachelor degree or higher. How to apply and what. Tick off a supervised professional year, including a minimum of 1,500 hours of work activities and 100 hours of structured training at a financial.

from www.abovethecanopy.us

A professional year of supervised experience. Make sure your financial adviser has an australian financial services (afs) licence or is an authorised representative. Afs licensees should ensure that a person they intend to authorise as a financial adviser has. To become a financial adviser, you must complete: To conduct a financial services business in australia, you must have an australian financial services (afs) licence. Getting optional certification to be a certified financial planner (cfp) Studying an approved course at a bachelor level or above. This is a register of people who provide personal advice on investments, superannuation and life insurance. You can become a financial adviser or planner in australia by: How to apply and what.

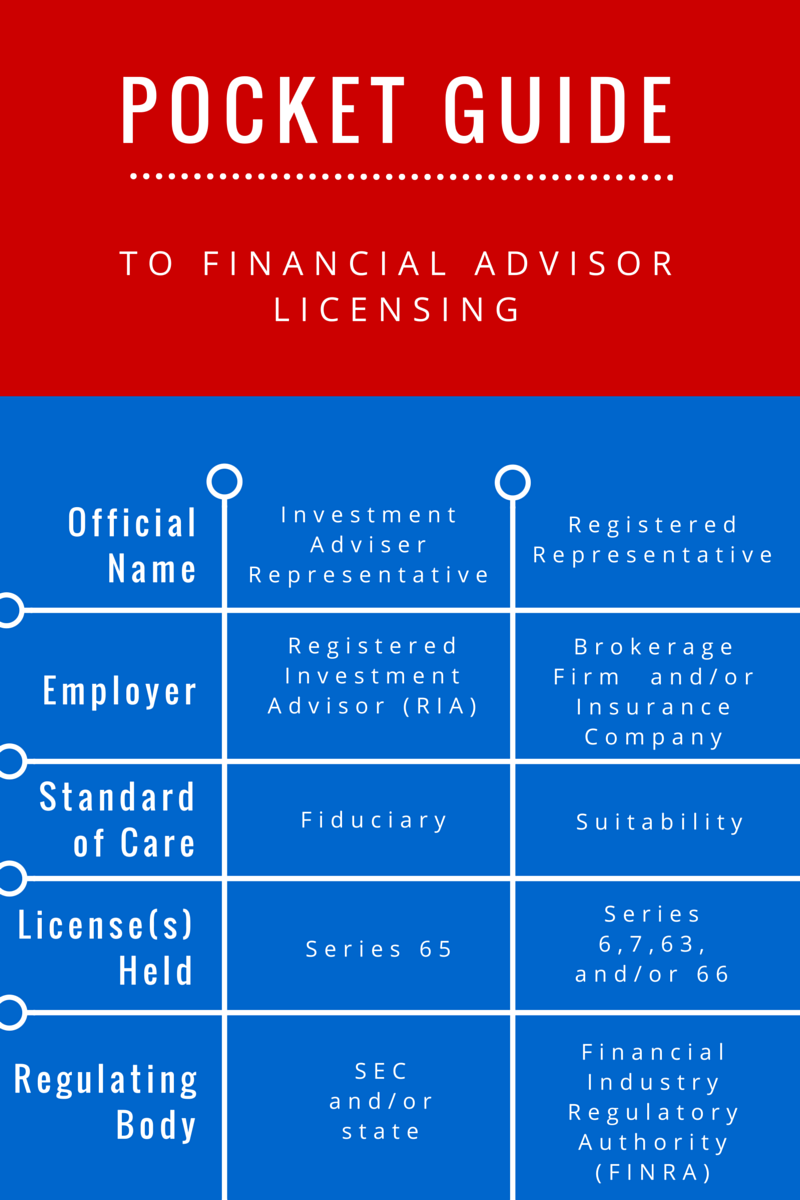

Pocket Guide to Financial Advisor Licensing Above the Canopy

Financial Advisor License Australia Afs licensees should ensure that a person they intend to authorise as a financial adviser has. A professional year of supervised experience. How to apply and what. This is a register of people who provide personal advice on investments, superannuation and life insurance. Tick off a supervised professional year, including a minimum of 1,500 hours of work activities and 100 hours of structured training at a financial. Studying an approved course at a bachelor level or above. To become a financial adviser, you must complete: Afs licensees should ensure that a person they intend to authorise as a financial adviser has. An approved bachelor degree or higher. Completing a supervised professional year (at least 1600 hours) passing the financial adviser exam. Make sure your financial adviser has an australian financial services (afs) licence or is an authorised representative. To conduct a financial services business in australia, you must have an australian financial services (afs) licence. Getting optional certification to be a certified financial planner (cfp) You can become a financial adviser or planner in australia by:

From expertbox.io

A Guide to Financial Advisor Licensing Financial Advisor License Australia An approved bachelor degree or higher. To become a financial adviser, you must complete: This is a register of people who provide personal advice on investments, superannuation and life insurance. Completing a supervised professional year (at least 1600 hours) passing the financial adviser exam. A professional year of supervised experience. Getting optional certification to be a certified financial planner (cfp). Financial Advisor License Australia.

From www.sandiegofinancialadvisorsnetwork.com

financial advisor sales license San Diego Financial Advisors Network Financial Advisor License Australia You can become a financial adviser or planner in australia by: Tick off a supervised professional year, including a minimum of 1,500 hours of work activities and 100 hours of structured training at a financial. A professional year of supervised experience. Getting optional certification to be a certified financial planner (cfp) To conduct a financial services business in australia, you. Financial Advisor License Australia.

From www.financestrategists.com

How Financial Advisors Make Money Finance Strategists Financial Advisor License Australia Completing a supervised professional year (at least 1600 hours) passing the financial adviser exam. Tick off a supervised professional year, including a minimum of 1,500 hours of work activities and 100 hours of structured training at a financial. Make sure your financial adviser has an australian financial services (afs) licence or is an authorised representative. A professional year of supervised. Financial Advisor License Australia.

From www.slideserve.com

PPT How To Get Australian Financial Services License PowerPoint Financial Advisor License Australia To become a financial adviser, you must complete: To conduct a financial services business in australia, you must have an australian financial services (afs) licence. Studying an approved course at a bachelor level or above. Getting optional certification to be a certified financial planner (cfp) Afs licensees should ensure that a person they intend to authorise as a financial adviser. Financial Advisor License Australia.

From www.lihpao.com

What Certifications Do You Need to Be a Financial Advisor? The Financial Advisor License Australia To become a financial adviser, you must complete: This is a register of people who provide personal advice on investments, superannuation and life insurance. How to apply and what. Getting optional certification to be a certified financial planner (cfp) To conduct a financial services business in australia, you must have an australian financial services (afs) licence. A professional year of. Financial Advisor License Australia.

From zoefin.com

A Complete Guide Different Types of Financial Advisors Zoe Financial Financial Advisor License Australia To become a financial adviser, you must complete: Make sure your financial adviser has an australian financial services (afs) licence or is an authorised representative. You can become a financial adviser or planner in australia by: Tick off a supervised professional year, including a minimum of 1,500 hours of work activities and 100 hours of structured training at a financial.. Financial Advisor License Australia.

From www.picpedia.org

Financial Advisor Free of Charge Creative Commons Post it Note image Financial Advisor License Australia An approved bachelor degree or higher. Getting optional certification to be a certified financial planner (cfp) To become a financial adviser, you must complete: This is a register of people who provide personal advice on investments, superannuation and life insurance. A professional year of supervised experience. Afs licensees should ensure that a person they intend to authorise as a financial. Financial Advisor License Australia.

From www.johnmacgregor.net

Selecting a Financial Advisor The Ultimate Guide Financial Advisor License Australia Completing a supervised professional year (at least 1600 hours) passing the financial adviser exam. Make sure your financial adviser has an australian financial services (afs) licence or is an authorised representative. You can become a financial adviser or planner in australia by: To conduct a financial services business in australia, you must have an australian financial services (afs) licence. Tick. Financial Advisor License Australia.

From www.tffn.net

How to a Certified Financial Advisor A StepbyStep Guide The Financial Advisor License Australia Studying an approved course at a bachelor level or above. Afs licensees should ensure that a person they intend to authorise as a financial adviser has. You can become a financial adviser or planner in australia by: Completing a supervised professional year (at least 1600 hours) passing the financial adviser exam. An approved bachelor degree or higher. To conduct a. Financial Advisor License Australia.

From www.lihpao.com

How to Get a Financial Advisor License A StepbyStep Guide The Financial Advisor License Australia To conduct a financial services business in australia, you must have an australian financial services (afs) licence. Studying an approved course at a bachelor level or above. Getting optional certification to be a certified financial planner (cfp) Completing a supervised professional year (at least 1600 hours) passing the financial adviser exam. This is a register of people who provide personal. Financial Advisor License Australia.

From www.picpedia.org

Financial Advisor Free of Charge Creative Commons Financial 11 image Financial Advisor License Australia To become a financial adviser, you must complete: Studying an approved course at a bachelor level or above. An approved bachelor degree or higher. Afs licensees should ensure that a person they intend to authorise as a financial adviser has. This is a register of people who provide personal advice on investments, superannuation and life insurance. Completing a supervised professional. Financial Advisor License Australia.

From www.sharepresentation.com

Investment Advisor Registration License Financial Advisor License Australia To become a financial adviser, you must complete: Make sure your financial adviser has an australian financial services (afs) licence or is an authorised representative. Getting optional certification to be a certified financial planner (cfp) A professional year of supervised experience. An approved bachelor degree or higher. Completing a supervised professional year (at least 1600 hours) passing the financial adviser. Financial Advisor License Australia.

From www.wiseradvisor.com

6 Financial Advisor Certifications You Need to Know Financial Advisor License Australia A professional year of supervised experience. Completing a supervised professional year (at least 1600 hours) passing the financial adviser exam. This is a register of people who provide personal advice on investments, superannuation and life insurance. Tick off a supervised professional year, including a minimum of 1,500 hours of work activities and 100 hours of structured training at a financial.. Financial Advisor License Australia.

From www.financestrategists.com

Financial Advisor Designations That Matter Finance Strategists Financial Advisor License Australia Getting optional certification to be a certified financial planner (cfp) To conduct a financial services business in australia, you must have an australian financial services (afs) licence. An approved bachelor degree or higher. Tick off a supervised professional year, including a minimum of 1,500 hours of work activities and 100 hours of structured training at a financial. Afs licensees should. Financial Advisor License Australia.

From www.abovethecanopy.us

Pocket Guide to Financial Advisor Licensing Above the Canopy Financial Advisor License Australia This is a register of people who provide personal advice on investments, superannuation and life insurance. You can become a financial adviser or planner in australia by: Make sure your financial adviser has an australian financial services (afs) licence or is an authorised representative. Getting optional certification to be a certified financial planner (cfp) Completing a supervised professional year (at. Financial Advisor License Australia.

From innovativewealth.com

Top 8 Titles Used by Financial Advisors Financial Advisor License Australia You can become a financial adviser or planner in australia by: Make sure your financial adviser has an australian financial services (afs) licence or is an authorised representative. This is a register of people who provide personal advice on investments, superannuation and life insurance. Getting optional certification to be a certified financial planner (cfp) Afs licensees should ensure that a. Financial Advisor License Australia.

From www.abovethecanopy.us

Pocket Guide to Financial Advisor Licensing Above the Canopy Financial Advisor License Australia Getting optional certification to be a certified financial planner (cfp) How to apply and what. A professional year of supervised experience. Completing a supervised professional year (at least 1600 hours) passing the financial adviser exam. Studying an approved course at a bachelor level or above. Make sure your financial adviser has an australian financial services (afs) licence or is an. Financial Advisor License Australia.

From smuggbugg.com

What License do Financial Advisors need to have? SmuGG BuGG Financial Advisor License Australia To conduct a financial services business in australia, you must have an australian financial services (afs) licence. You can become a financial adviser or planner in australia by: This is a register of people who provide personal advice on investments, superannuation and life insurance. Studying an approved course at a bachelor level or above. An approved bachelor degree or higher.. Financial Advisor License Australia.